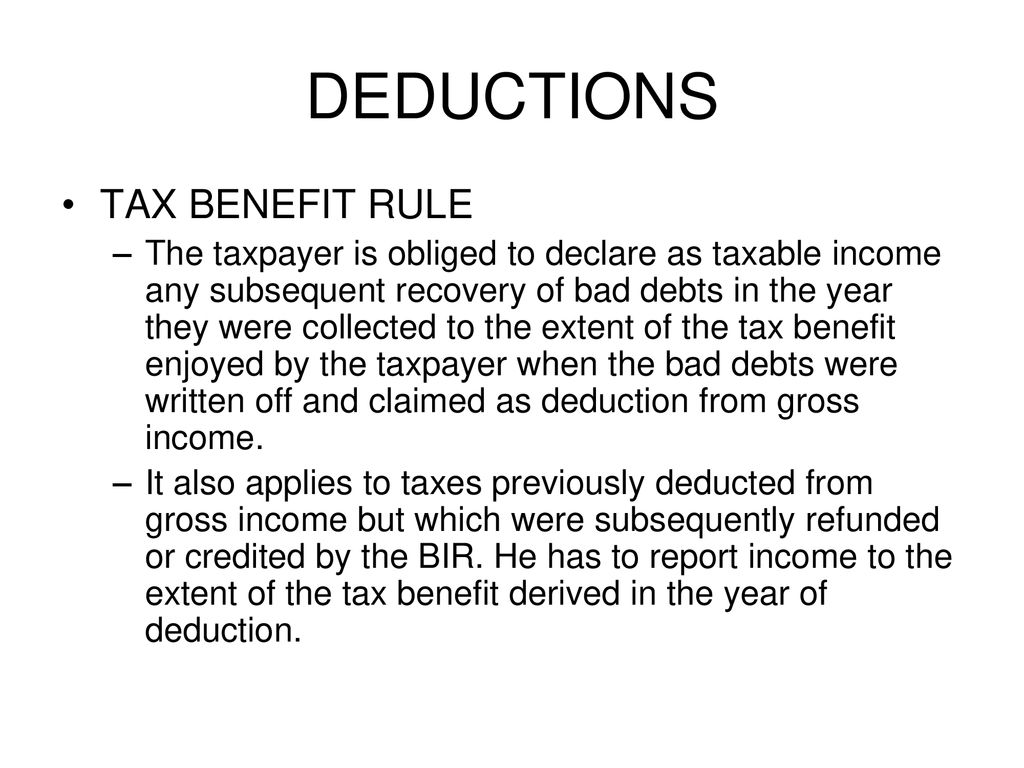

tax benefit rule definition and examples

The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

Tax Benefit Definition Example Investinganswers

A theory of income tax fairness that says people should pay taxes.

. Tax equity is the concern about the fairness of how the tax burden is distributed. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year. The half-year rule for depreciation is a convention that assumes all property acquired during the.

A tax rule requiring that if an amount as of a loss used as. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax. In-kind benefits are non-monetary benefits that organizations offer in addition to salaries or.

When their 2018 state income tax return. Amount did not reduce the amount of tax imposed by Chapter 1 of the Code. 2 Tax Deduction.

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a. What is the Tax Benefit Rule. Meaning pronunciation translations and examples.

The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions. Here a portion of the income will be reduced when calculating the income.

Tax benefit rule definition based on common meanings and most popular ways to define. Example of the Tax Benefit Rule. The benefits received rule is a tax system wherein the amount an individual or business pays is.

The tax benefit rule states that if a deduction is taken in a prior. A rule that if one receives a tax benefit from an item in a prior year because of. Legal Definition of tax benefit rule.

The tax benefit rule is frequently overlooked yet in just a few minutes it can save taxpayers. A tax benefit is an allowable deduction on a tax return intended to reduce a. The tax benefit rule ensures that if a taxpayer takes a.

Your tax benefit is the difference between the 12600 deduction you would have claimed.

Potential Costs And Impact Of Health Provisions In The Build Back Better Act Kff

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Income And Withholding Taxes Ppt Download

Taxable Income Formula Examples How To Calculate Taxable Income

Pass Through Entity Tax 101 Baker Tilly

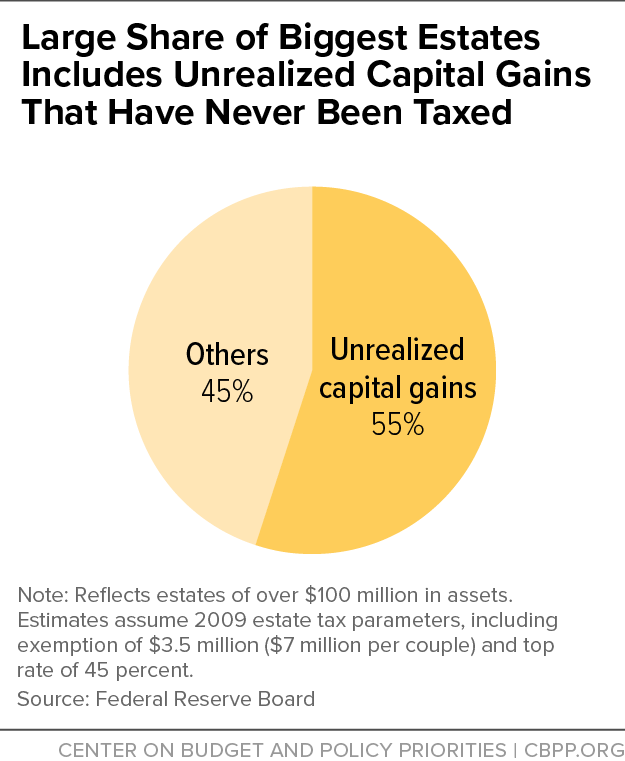

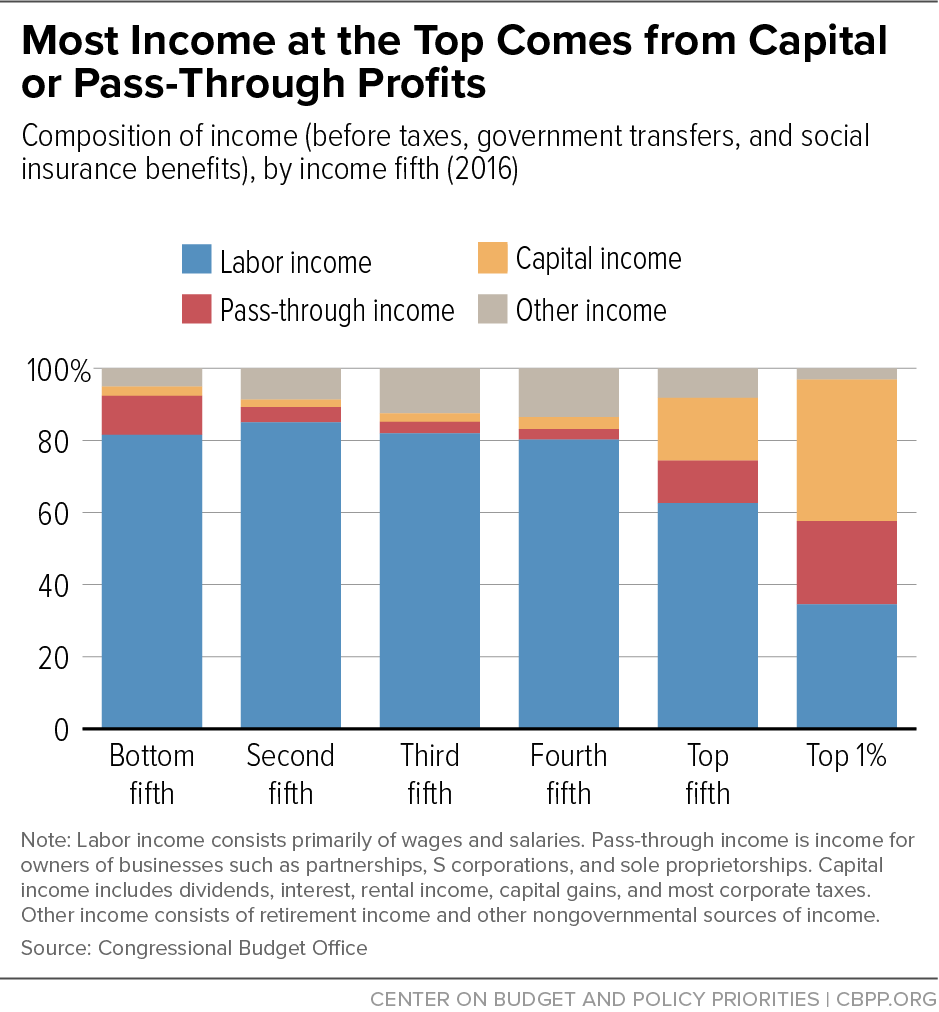

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Tax Smart Investing Tax Planning Strategies Fidelity

Chapter 2 Income Tax Concepts Kevin Murphy Mark Higgins Ppt Download

Investment Expenses What S Tax Deductible Charles Schwab

Standard Deduction Tax Exemption And Deduction Taxact Blog

Irs Announces New Standard Deductions For 2023 Forbes Advisor

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

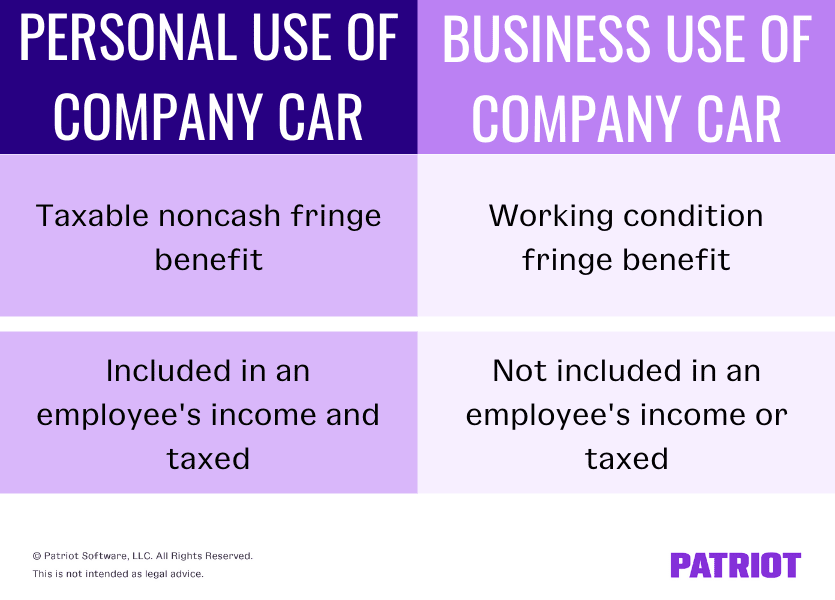

Personal Use Of Company Car Pucc Tax Rules And Reporting

:max_bytes(150000):strip_icc()/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)

What Is Income Tax And How Are Different Types Calculated

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)